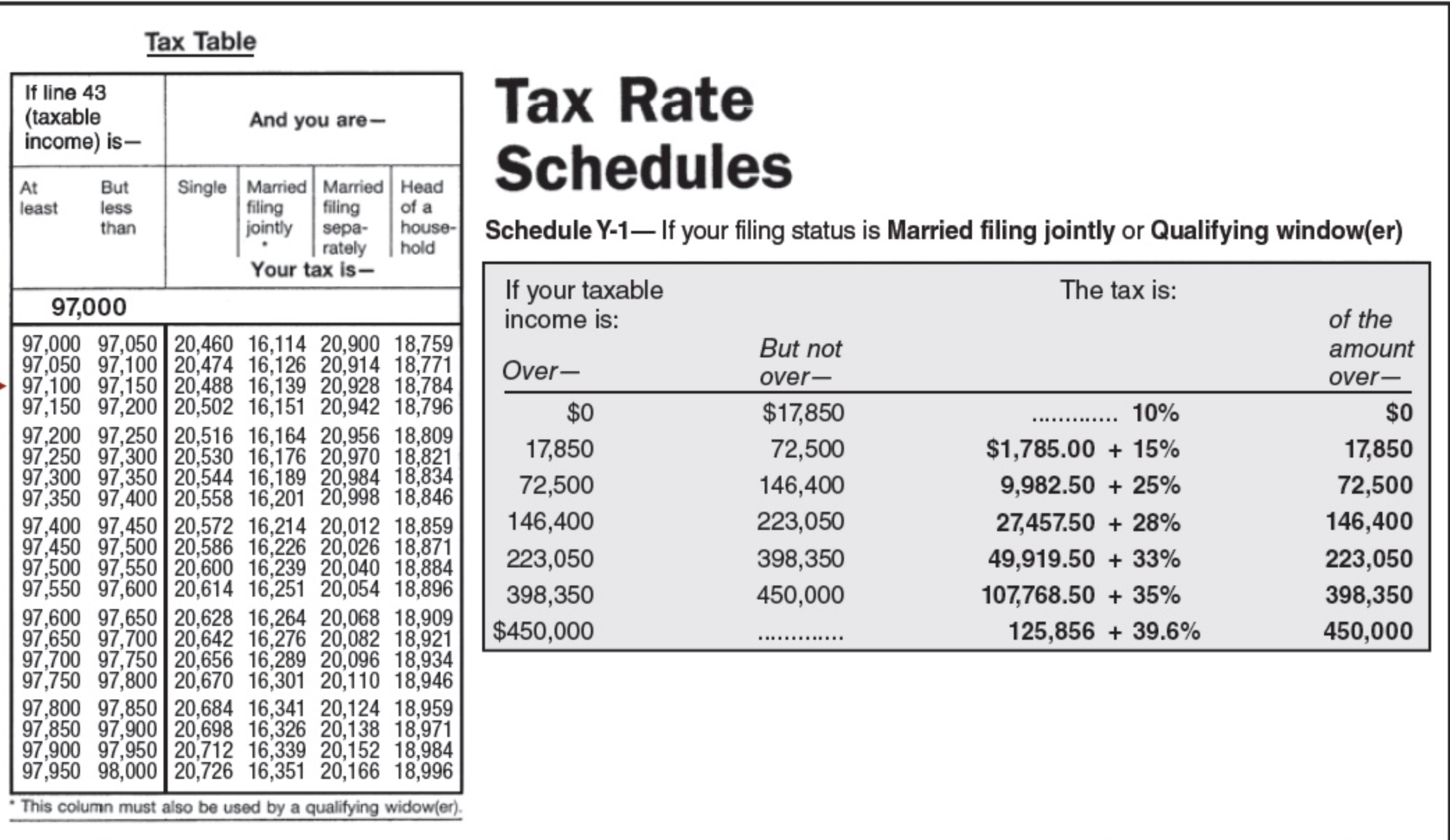

| Using the tax table in Exhibit 3-5, determine the amount of taxes for the following situations: |

| a. | A head of household with taxable income of $97,951. |

| Tax amount | $ |

| b. | A single person with taxable income of $97,941. |

| Tax amount | $ |

| c. | A married person filing a separate return with taxable income of $97,950. |

| Tax amount | $

|

A head of household with taxable income of $97,951.

Answer:

18,984

B

A single person with taxable income of $97,941.

Answer :

$ 20,712

C

A married person filing a separate return with taxable income of $97,950.

Answer:

$ 20152

The limits of income ans tax amount was given in the schedule in the sum .If we compare line by line we will find the amount as given in the schedule of the sum